When I was in my early twenties I applied for a small personal loan 但 I was denied due to a poor credit score. When I enquired, the credit scoring agency said my lack of history was the reason. 令人沮丧的是,我没有债务记录, 不是我的月收入和健康的银行存款, 是决定性因素.

I was excited when peer-to-peer (P2P) lending emerged in the mid-2000s, as I could see that it had the potential to escape the rigid credit score system and allow many more people access to credit. Early critics said P2P would be too susceptible to fraud without an intermediary carrying out due diligence. Granted, there have been some issues, 但 it is now a proven system, with P2P支付每年超过1万亿美元, and the revenue from these loans expected to grow to almost $900bn by 2024.

To achieve this growth P2P lenders have had to go after the more “risky” customers – as far as a credit score would determine, 但, 最重要的是, 就违约可能性而言,风险并不大. It is interesting how some P2P lenders are using Artificial Intelligence and Machine Learning (AI-ML) to help better understand risk and build successful loan businesses in the process.

银行可以从P2P AI-ML应用中学到什么?

P2P lender Upstart claims that AI-ML has helped them reduce fraud, unlock new viable lending opportunities that traditional lenders have overlooked, and automate the loan 批准 process for a better customer experience at lower cost.

P2P lenders like Upstart would argue that banks rely too heavily on an individual’s credit score. In comparison, they have to gather as much data as possible on the loan applicant (e.g. 教育, 工作经历, how they interact with the application) before applying AI-ML techniques to analyse the data to accurately model risk and make smarter lending decisions. Their model is constantly learning by observing the performance of the loans to inform the price of the next loan. AI-ML还用于检测欺诈和欺诈行为 自动化60%的应用程序. 在这样做的过程中,他们取得了成就 违约率降低75% compared to large banks with the same 批准 rate.

银行已经掌握了大部分数据, 有时更多, so what’s preventing the adoption of AI-ML to unlock these opportunities?

Banks have rigid risk practices, and for good reasons. AI-ML将为信用风险团队带来新的见解. 他们如何适应和应对将是关键. This will require careful 教育 on how credit risk practices are changing from the board level, 一直到信用风险管理人员. Who leads and drives these changes is often unclear. And it is through that foggy sea of uncertainty that banks struggle to adapt to these changes in a quick and agile manner.

There is also a fear that regulators might view this as a weakening in the bank’s safeguard against financial crime.

Whilst we’re finding that regulators are understandably cautious about new technologies, they clearly recognise AI-ML as a means to improve access to credit and fight financial crime. P2P lenders have been demonstrating that appropriate safeguards can be applied to their lending techniques, 导致他们 批准 继续沿着这条路走下去.

How can banks safely accelerate the adoption of AI-ML into the loan application process?

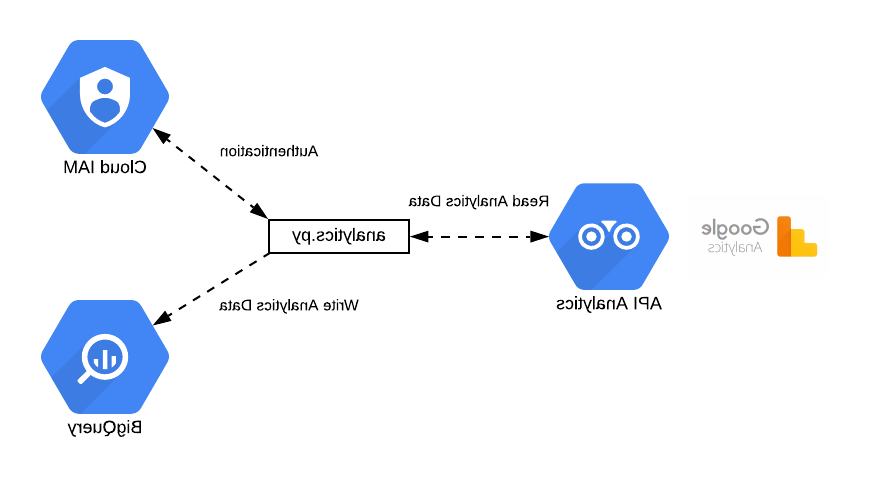

For those in the bank that recognise the value of having AI-ML insights applied to the loan 批准 process they’ve encountered challenges: from getting the data into the cloud, to applying the insights to their loan 批准 process.

而不是建立自己的AI-ML贷款模型, some smaller banks are using the P2P provider’s “lending-as-a-service” platforms. 然而, Tier 1 and 2 banks want to build their own platforms and make use of the huge treasure trove of data they hold on customers. An inconvenient precursor to this is implementing unified data strategies, 哪些是不小的事业. Banks should prioritise their data lineage projects so that they can identify and effectively process the plethora of data points that can be integrated into the loan decision process.

I am proud of what P2P lenders are trying to achieve through their application of AI-ML. 我相信银行可以享受到这些好处, 甚至更多, when they implement AI-ML in their lending businesses. It’s no surprise that this needs to go far broader than the lending business though. Information overload and system complexity are huge challenges. 在某种程度上,大数据已经成为问题所在. AI-ML就是答案. It is the only form of intelligence that can convert all that unstructured data into useful knowledge. Until AI-ML is implemented across the bank big data will remain a locked safe.